Welcome

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

Early Christmas gift. . . On December 23, 2022 the IRS decided to delay implementation of the 1099K reporting for tax year 2022. Translation: The American Rescue Act (2021) required E commerce platforms (e.g. Ebay, Mercari, Amazon) to provide a 1099K form to sellers receiving more than $600 through the platform website. The … Tax newsletter update–1099K rules

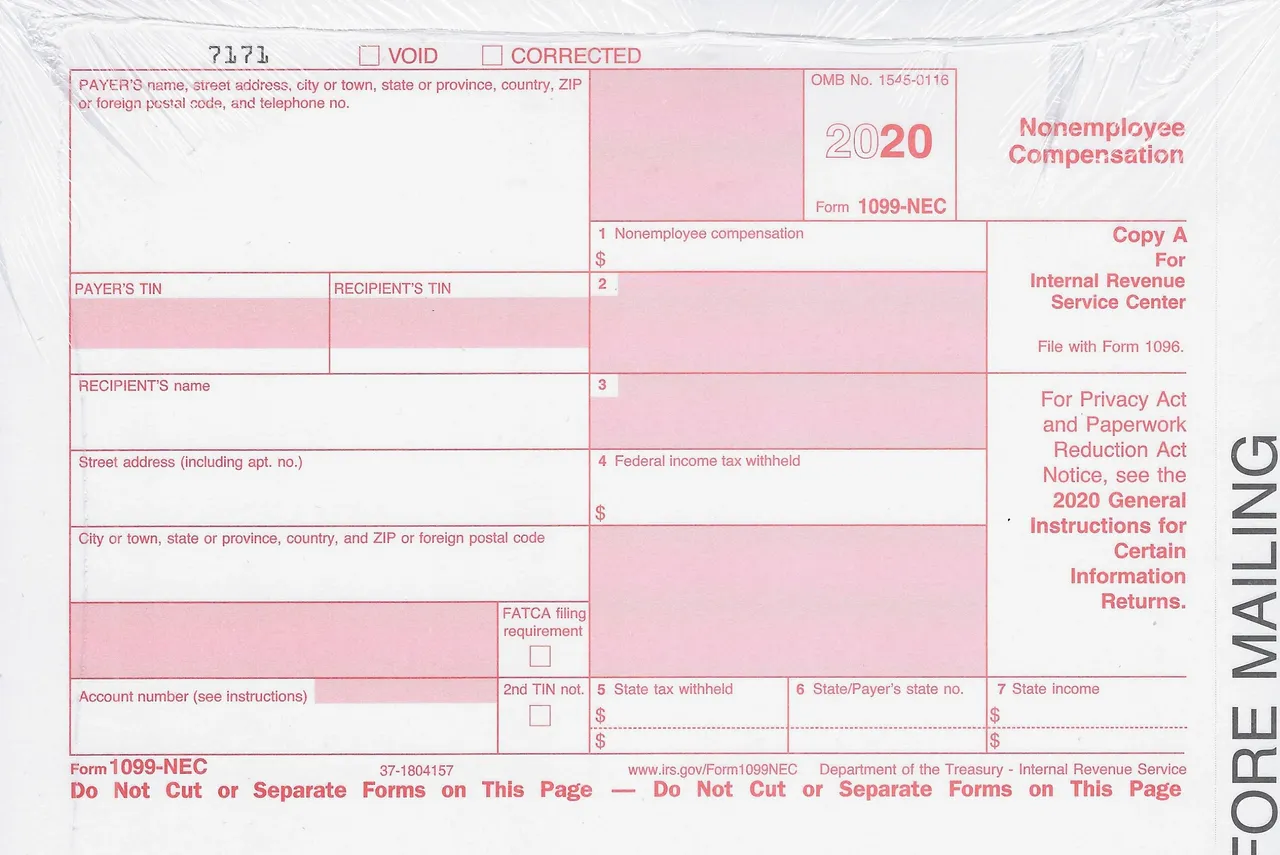

From IRS Tax Court Case Quezada v. IRS, 2020 PTC 382 (5th Cir. 2020) . Background: Form 1099MISC Rules. Usually if business hires a subcontractor in their line of business and pays them $600 or more during the year, the contractor should be given Form 1099 MISC form to document payment for services. Exceptions … Business Using Subcontractors? Incorrect Info Could = Taxes!