Welcome

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

IRS is processing its backlog and is issuing lots of “love letters” otherwise known as Tax Notices. Many of the 2020 Tax year tax notices are for Recovery Credit. For Tax Year 2020, Taxpayers not receiving the the full stimulus amount for both payments ($1200 per adult and/or $500 per child received March -May … Love Letters & the IRS (Recovery Credit Tax Notices Part II)

An old parable indicates that a live frog will consent to being cooked if the heat is slowly increased. Seems that the same principle applies to taxes. Part of the Build Back Better Act of 2021 is being crafted in the House Ways and Means Committee. It’s not law yet, but the provisions discussed … Tax Increases and the Slowly Roasted Frog. . .

Been getting a lot of calls for IRS Notices. Most of them seem to be related to the Stimulus Payment or “Recovery Rebate Credit”. The Recovery Rebate is a reconcile. Taxpayers not receiving the full amount of stimulus payment one (Paid out March-May 2020) or Stimulus Payment two (paid out January thru March 2021), can … I was Getting a Refund but Got an IRS Bill . . . ?

YES and NO. The American Rescue Act was passed March 11, 2021. It made an additional refunds available to some Taxpayers. There’s no additional refund (“Hidden Treasure”) available for Taxpayers who filed their 2020 tax return before March 31, 2021 claiming only wages and federal unemployment income. The IRS automatically processes an additional refund for … Hidden Treasure: Will Amending 2020 Taxes Provide Additional $$?

Refunds are taking longer this year. Refunds are delayed if the 2020 tax year return: Claims Child Tax Credit. . For children under the age of 17 or a reduced amount for College Students or disabled children. . Refunds are subject to extra scrutiny because of fraud. Earned Income Credit . . . for … Where’s My Refund? It’s been 6 weeks, 10 weeks, 12 weeks

Never fear! The IRS has two programs to assist. For simple tax returns with taxable income under $72,000: IRS provides free tax preparation under the IRS Free file program. Taxpayers are given access to free tax software to file their tax return. Some software does not support local tax returns (e.g. School District or … But I CAN’T AFFORD a Tax Preparer

IRS is going to be running a little “late” this year. According to the information received as of today (January 15, 2021), IRS will start processing 2020 Tax Year individual Tax Returns February 12, 2021. Tax Returns can be prepared before February 12 processing date. Estimated refund processing times for returns that refund extra … Need Refund? Patience Please!

As you may have heard, President Trump signed the “COVID Relief Part 4 ( Formally known as Continuing Appropriations Act of 2021)” into law recently. Payment amount will be $600 per qualified recipient ($1200 per Married Couple) plus $600 per dependent child claimed on the tax return. As before, no payments are available for … Stimulus Payments Part 2

UPDATE 12-23-2020: This bill was passed by Congress but President Trump will not sign it. Thinks the $600 is too small a check for American Taxpayers when the same bill (tentative law) gives millions to foreign countries. Bill has been sent back to Congress for Modification. . .will keep you posted. Per initial legislative … Congress COVID Christmas Present–UPDATED 12-23-2020

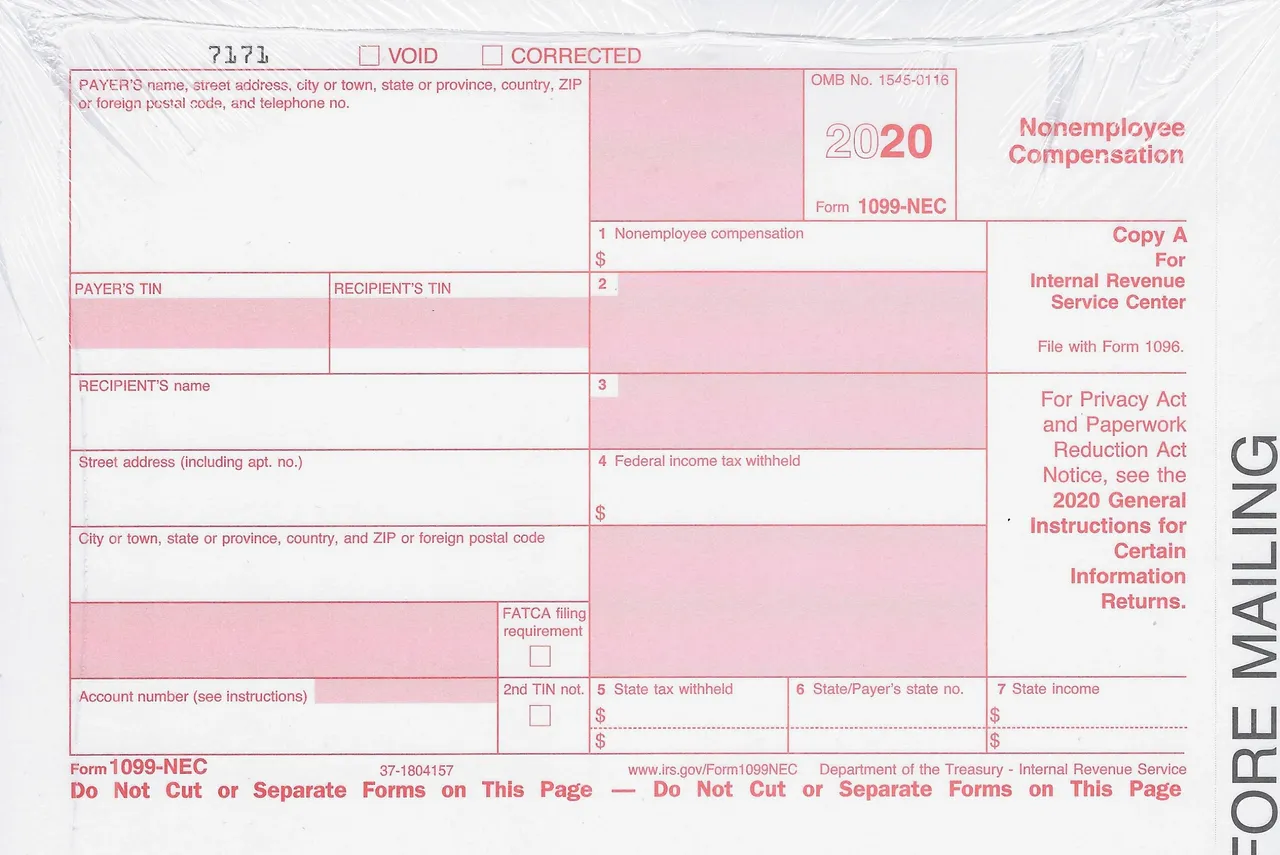

From IRS Tax Court Case Quezada v. IRS, 2020 PTC 382 (5th Cir. 2020) . Background: Form 1099MISC Rules. Usually if business hires a subcontractor in their line of business and pays them $600 or more during the year, the contractor should be given Form 1099 MISC form to document payment for services. Exceptions … Business Using Subcontractors? Incorrect Info Could = Taxes!