Welcome

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

YES and NO. The American Rescue Act was passed March 11, 2021. It made an additional refunds available to some Taxpayers. There’s no additional refund (“Hidden Treasure”) available for Taxpayers who filed their 2020 tax return before March 31, 2021 claiming only wages and federal unemployment income. The IRS automatically processes an additional refund for … Hidden Treasure: Will Amending 2020 Taxes Provide Additional $$?

Refunds are taking longer this year. Refunds are delayed if the 2020 tax year return: Claims Child Tax Credit. . For children under the age of 17 or a reduced amount for College Students or disabled children. . Refunds are subject to extra scrutiny because of fraud. Earned Income Credit . . . for … Where’s My Refund? It’s been 6 weeks, 10 weeks, 12 weeks

Never fear! The IRS has two programs to assist. For simple tax returns with taxable income under $72,000: IRS provides free tax preparation under the IRS Free file program. Taxpayers are given access to free tax software to file their tax return. Some software does not support local tax returns (e.g. School District or … But I CAN’T AFFORD a Tax Preparer

IRS is going to be running a little “late” this year. According to the information received as of today (January 15, 2021), IRS will start processing 2020 Tax Year individual Tax Returns February 12, 2021. Tax Returns can be prepared before February 12 processing date. Estimated refund processing times for returns that refund extra … Need Refund? Patience Please!

As you may have heard, President Trump signed the “COVID Relief Part 4 ( Formally known as Continuing Appropriations Act of 2021)” into law recently. Payment amount will be $600 per qualified recipient ($1200 per Married Couple) plus $600 per dependent child claimed on the tax return. As before, no payments are available for … Stimulus Payments Part 2

UPDATE 12-23-2020: This bill was passed by Congress but President Trump will not sign it. Thinks the $600 is too small a check for American Taxpayers when the same bill (tentative law) gives millions to foreign countries. Bill has been sent back to Congress for Modification. . .will keep you posted. Per initial legislative … Congress COVID Christmas Present–UPDATED 12-23-2020

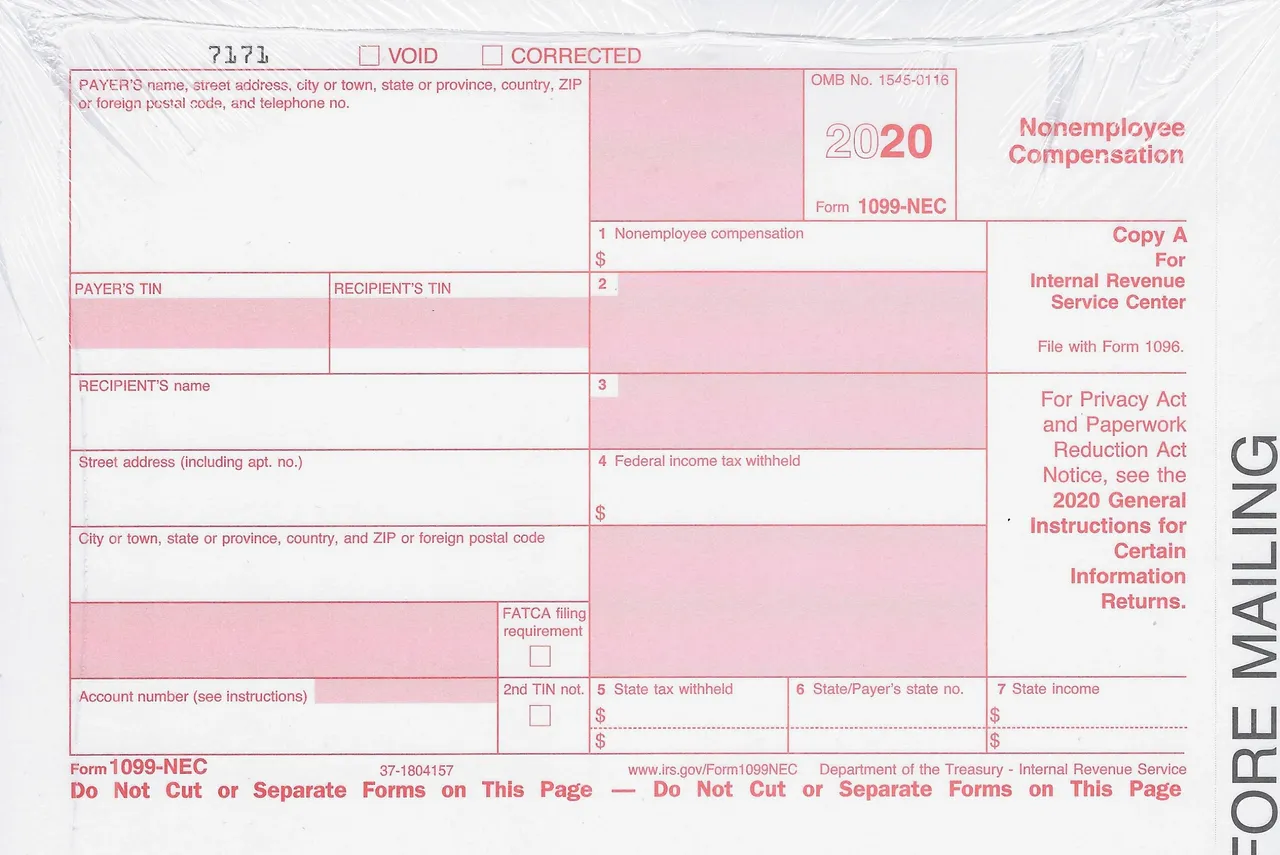

From IRS Tax Court Case Quezada v. IRS, 2020 PTC 382 (5th Cir. 2020) . Background: Form 1099MISC Rules. Usually if business hires a subcontractor in their line of business and pays them $600 or more during the year, the contractor should be given Form 1099 MISC form to document payment for services. Exceptions … Business Using Subcontractors? Incorrect Info Could = Taxes!

Beginning on Jan. 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: • 56 cents per mile for business use • 16 cents per mile driven for medical purposes • 14 cents per mile driven in service of charitable organizations

A question received: I’ve worked from home since March 2020 because of COVID. Can I claim my home office expenses on my 2020 taxes? The tax year and the employment status (employee vs sub contractor or self employed) matters. For 2020 tax year, there may be a home office tax deduction for: 1. Subcontractor (No … COVID Reveals a BROKEN “Tax Cookie Jar” for At Home Employees

Currently choice is one of the buzzwords. Usually it refers to something I don’t agree with. However, when it comes to personal freedom and governmental affairs I want: A choice to select the exact health insurance coverage I need and can afford. Choice denied under Obamacare. For example, I don’t need maternity care and … I WANT A CHOICE TOO—Editorial